We are Latin America’s leading business intelligence platform

With 30 years of experience, we provide data-driven strategic insights to help you access new business opportunities, make informed decisions, and stay ahead of key market trends.

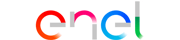

Discover the tools that provide critical business intelligence and market insights

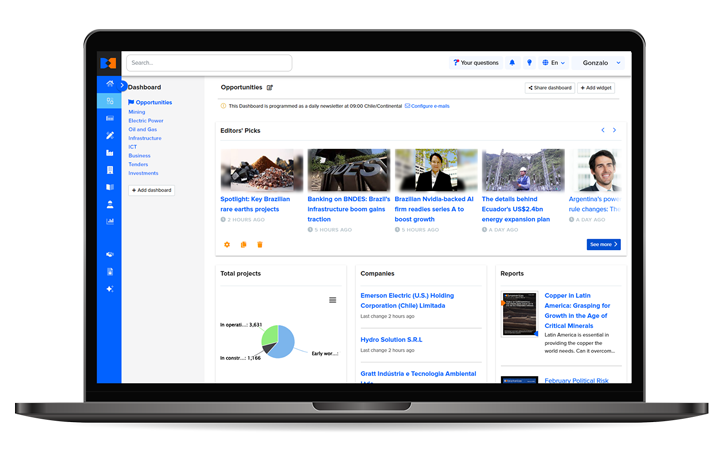

Projects

Track major projects in your industry and identify key investment opportunities.

Companies

Analyze competitors and potential clients with updated data and key insights.

Contacts

Connect with key executives and decision-makers across various industries.

News

Access up-to-date data and analysis on the region, curated by on-the-ground experts.

Forecast

Get early insights on future projects in Latin America to plan ahead effectively.

Reports

Access detailed market reports to predict trends and make informed business decisions.

Factiva

Stay informed with real-time news from over 3,100 trusted sources worldwide.

Custom Files

Request updated data on projects, companies, or contacts in your preferred format.

Datasets

Access historical and real-time industry data for strategic analysis and decision-making.

Pipeline

Optimize sales and business development with a pipeline tracking projects and insights.

Projects

Track major projects in your industry and identify key investment opportunities.

Companies

Analyze competitors and potential clients with updated data and key insights.

Contacts

Connect with key executives and decision-makers across various industries.

News

Access up-to-date data and analysis on the region, curated by on-the-ground experts.

Forecast

Get early insights on future projects in Latin America to plan ahead effectively.

Reports

Access detailed market reports to predict trends and make informed business decisions.

Factiva

Stay informed with real-time news from over 3,100 trusted sources worldwide.

Custom Files

Request updated data on projects, companies, or contacts in your preferred format.

Datasets

Access historical and real-time industry data for strategic analysis and decision-making.

Pipeline

Optimize sales and business development with a pipeline tracking projects and insights.

Who is BNamericas for?

Explore how our platform helps different sectors make strategic decisions with reliable data and business analysis in Latin America.

Contractors

Discover business opportunities in strategic projects, minimize risks, and access key data for planning and bidding.

Providers

Connect with projects needing your products, identify opportunities, and optimize lead generation with industry contacts.

Owners & Operators

Evaluate investments, optimize asset management, identify opportunities, and analyze projects with key market data.

Consultants

Access market intelligence and strategic reports for accurate guidance and real-time industry analysis.

Financial Services

Identify financing opportunities, access economic projections, and improve risk assessment with reliable financial data.

Legal Services

Stay ahead of regulatory changes, access up-to-date legal information, and provide strategic advisory with detailed analysis.

Government

Explore public and private investment opportunities, analyze trends, and get critical data on regional regulations and policies.

Insurance

Review risks in key projects, gain industry intelligence, and connect with businesses needing strategic insurance solutions.

Contractors

Discover business opportunities in strategic projects, minimize risks, and access key data for planning and bidding.

Providers

Connect with projects needing your products, identify opportunities, and optimize lead generation with industry contacts.

Owners & Operators

Evaluate investments, optimize asset management, identify opportunities, and analyze projects with key market data.

Consultants

Access market intelligence and strategic reports for accurate guidance and real-time industry analysis.

Financial Services

Identify financing opportunities, access economic projections, and improve risk assessment with reliable financial data.

Legal Services

Stay ahead of regulatory changes, access up-to-date legal information, and provide strategic advisory with detailed analysis.

Government

Explore public and private investment opportunities, analyze trends, and get critical data on regional regulations and policies.

Insurance

Review risks in key projects, gain industry intelligence, and connect with businesses needing strategic insurance solutions.

Business Intelligence for Latin America’s Key Industries

Electric Power

Track industry trends and project details in solar, wind, hydro, and thermal energy.

Explore Electric Power Explore Electric Power Explore Electric PowerFinancial Services

Stay informed on banking trends, insurance markets, and financial regulations.

Explore Financial Services Explore Financial Services Explore Financial ServicesICT

Analyze digital transformation trends shaping industries in Latin America.

Explore ICT Explore ICT Explore ICTInfrastructure

Access insights on public and private investment plans and regulations.

Explore Infrastructure Explore Infrastructure Explore InfrastructureMining & Metals

Track commodity prices, industry trends, and investment opportunities.

Explore Mining & Metals Explore Mining & Metals Explore Mining & MetalsOil & Gas

Stay updated on investment trends, regulatory changes, and price fluctuations.

Explore Oil & Gas Explore Oil & Gas Explore Oil & GasPetrochemicals

Monitor industry competition, legislative updates, and emerging trends.

Explore Petrochemicals Explore Petrochemicals Explore PetrochemicalsWater & Waste

Follow regulatory updates, industry risks, and treatment innovations.

Explore Water & Waste Explore Water & Waste Explore Water & WasteDaily industry intelligence and real-time insights for informed decision-making

Expert-driven market data, enhanced with AI, for smarter business decisions.

Accurate data and clear insights

Access updated information and detailed analysis that will help you anticipate market trends and achieve your business goals.

Trusted by industry leaders

See how companies grow with our market intelligence.

“BNamericas has become a valued business partner for our firm over the years. Not only delivering relevant information and data but understanding and delivering insights on changes in the industry and the market”

“BNamericas has become a valued business partner for our firm over the years. Not only delivering relevant information and data but understanding and delivering insights on changes in the industry and the market”

“BNamericas is an unique source of strategic information for the infrastructure industry in Latin America, covering political trends, regulatory issues, upcoming tenders, etc. in a very friendly platform. No matter if you are policy maker, a sponsor, a financier or a specialist, having BNamericas in your daily breakfast menu will keep you connected to all important facts of the region”

“BNamericas is an unique source of strategic information for the infrastructure industry in Latin America, covering political trends, regulatory issues, upcoming tenders, etc. in a very friendly platform. No matter if you are policy maker, a sponsor, a financier or a specialist, having BNamericas in your daily breakfast menu will keep you connected to all important facts of the region”

“I trust BNamericas for my information needs in Latin America and the Caribbean. BNamericas has built an impressive database and a powerful search engine that makes research in any energy subject a breeze”

“I trust BNamericas for my information needs in Latin America and the Caribbean. BNamericas has built an impressive database and a powerful search engine that makes research in any energy subject a breeze”

”I have relied on the business news and industry insight provided by BNamericas since its inception, and I have no hesitation in recommending a subscription to BNamericas as I am sure it will help you identify prospects and grow your business, as it has done for us”

”I have relied on the business news and industry insight provided by BNamericas since its inception, and I have no hesitation in recommending a subscription to BNamericas as I am sure it will help you identify prospects and grow your business, as it has done for us”

“Every morning BNamericas is my first source for news; it provides me with a complete view of the Latam energy and infrastructure sectors in the most efficient matter”

“Every morning BNamericas is my first source for news; it provides me with a complete view of the Latam energy and infrastructure sectors in the most efficient matter”

”Our team has greatly benefited from our subscription to BNamericas, partly due to its unique breadth across various industry sectors”

”Our team has greatly benefited from our subscription to BNamericas, partly due to its unique breadth across various industry sectors”

“BNamericas has become a valued business partner for our firm over the years. Not only delivering relevant information and data but understanding and delivering insights on changes in the industry and the market”

“BNamericas has become a valued business partner for our firm over the years. Not only delivering relevant information and data but understanding and delivering insights on changes in the industry and the market”

“BNamericas is an unique source of strategic information for the infrastructure industry in Latin America, covering political trends, regulatory issues, upcoming tenders, etc. in a very friendly platform. No matter if you are policy maker, a sponsor, a financier or a specialist, having BNamericas in your daily breakfast menu will keep you connected to all important facts of the region”

“BNamericas is an unique source of strategic information for the infrastructure industry in Latin America, covering political trends, regulatory issues, upcoming tenders, etc. in a very friendly platform. No matter if you are policy maker, a sponsor, a financier or a specialist, having BNamericas in your daily breakfast menu will keep you connected to all important facts of the region”

“I trust BNamericas for my information needs in Latin America and the Caribbean. BNamericas has built an impressive database and a powerful search engine that makes research in any energy subject a breeze”

“I trust BNamericas for my information needs in Latin America and the Caribbean. BNamericas has built an impressive database and a powerful search engine that makes research in any energy subject a breeze”

”I have relied on the business news and industry insight provided by BNamericas since its inception, and I have no hesitation in recommending a subscription to BNamericas as I am sure it will help you identify prospects and grow your business, as it has done for us”

”I have relied on the business news and industry insight provided by BNamericas since its inception, and I have no hesitation in recommending a subscription to BNamericas as I am sure it will help you identify prospects and grow your business, as it has done for us”

“Every morning BNamericas is my first source for news; it provides me with a complete view of the Latam energy and infrastructure sectors in the most efficient matter”

“Every morning BNamericas is my first source for news; it provides me with a complete view of the Latam energy and infrastructure sectors in the most efficient matter”

”Our team has greatly benefited from our subscription to BNamericas, partly due to its unique breadth across various industry sectors”

”Our team has greatly benefited from our subscription to BNamericas, partly due to its unique breadth across various industry sectors”