Spotlight: The state of play in Brazil’s telecoms industry

Expansion of broadband driven by internet service providers (ISPs), growth in standalone 5G lines and drops in fixed telephony and pay-TV accesses are the main talking points in the latest figures on Brazil’s telecoms market as of end-August, according to data compiled by regulator Anatel.

The country had just over 347mn telecoms accesses as of August 31, including broadband, fixed telephony, mobile lines and pay TV, which was roughly 1mn more than at the end of July and a gain of 12.3mn compared with the end of August 2021.

Mobile telephony accounted for 261mn of those accesses, fixed broadband 43.7mn, fixed telephony 27.5mn and pay-TV 14.7mn.

The first two saw month-on-month growth, while landlines and pay TV recorded new drops.

BNamericas take a closer look at the figures for each service.

MOBILE TELEPHONY

Anatel now says there are 3.6mn 5G lines in the country, comprising both “pure” 5G (standalone, or SA) format and the DSS technology (non-standalone or NSA), which largely relies on existing spectrum and the 4G network.

At the end of August, 3.3mn of these accesses were DSS, with Telefônica Brasil accounting for 40.5%, Claro 38.4% and TIM 21.1%.

In 5G SA, for which figures were first reported by Anatel following the beginning of the network activations in July, 316,737 of the accesses reported belong to Claro. TIM appears with just 130, while Telefônica had none.

The likely explanation is that as the SA service only just started being deployed in the country’s state capitals, carriers have not properly compiled the data in their reports to Anatel.

Overall, Brazil had 261.3mn mobile lines in service at end-August, up from 260.2mn at the end of July and 12.8mn more than at the end of August 2021.

Market leader Telefônica Brasil had 38.3% of the total mobile lines in the country, compared with 38.2% in July, breaking the milestone of 100mn mobile accesses for the first time.

It is ahead of Claro (33%, flat), TIM (26.4%, down from 26.5%), Algar (1.6%, flat) and others (0.7%, up from 0.6%).

Postpaid accounted for 53.9% of the total, up from 53.8% in July, with prepaid on 46.1%.

Some 79% of the mobile lines are also served with 4G, while 3G accesses declined to 10.1%, and 2G lines were up slightly to 9.5%. The remainder were served by 5G.

FIXED BROADBAND

Total fixed broadband accesses reached 43.7mn at the end of August, up from 43.4mn at end-July according to Anatel’s updated figures.

That growth was driven mostly by regional carriers and ISPs' activations of fiber-to-the-home.

Fiber now represents 67.3%, or 29.6mn, of all fixed broadband connections in the country, having seen growth of 5.7mn accesses in one year. The remainder were coaxial cable (20.6%), metal cable (6.8%), radio (4%) and satellite (0.8%) connections.

Small ISPs and local providers led the market with a combined market share of 36.8% in overall fixed broadband and 45.5% in fiber broadband connections.

This group excludes ISPs and telcos with a market share of more than 1%, which include EB Fibra (Alloha, with 2.8% of the fixed broadband total), Brisanet (2.3%), Algar (1.8%), Desktop (1.7%), TIM (1.6%), Vero (1.6%), Unifique (1.4%), AmericaNet (1.2%) and Triple Play (1.2%).

Alloha is a holding company that controls the ISPs Sumicity, VIP, Liga and Mob, among others. It is owned by private equity EB Capital, which, according to the latest market reports, is looking to split Alloha into an infrastructure operation and a service (customer) operation, putting the former up for sale and retaining the latter.

Claro remains the leading single operator, with 22.3% of all fixed broadband connections, down from 22.5% in July), followed by Telefônica Brasil (14.6%, down from 14.7%) and Oi (11.7%, down from 11.8%).

PAY TV AND FIXED TELEPHONY

Pay TV subscriptions dropped again in August, falling to 14.7mn from 14.9mn at the end of July. Since August 2021, the service has lost over 1.5mn subscribers.

The segment is led by Claro, with 43.1% of all subscriptions, which was flat month-on-month. Next is Sky (28.2%, up from 28.0% in July), Oi (19.0%, down from 19.2%), Telefônica (6.9%, up from 6.8%), and others (3.0%, flat).

Satellite DTH accounted for 57.5% of all pay-TV accesses as of the end of August, flat in percentage terms, and ahead of coaxial cable (33.5%, down from 33.6%) and fiber (9.0%, up from 8.9%).

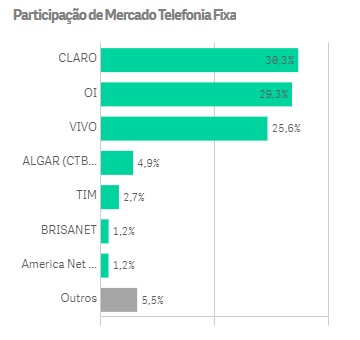

Finally, fixed telephony contracts totalled 27.5mn at end-August, down from 27.9mn in July and 29.6mn in August 2021.

Considering all types of contracts, Claro led this segment too, with a 30.3% market share, up from 30.0% in July, followed by Oi (29.3% up from 29.1%), Telefônica (25.6%, up from 25.3%), Algar Telecom (4.9%, up from 4.8%) and TIM (2.7%, flat).

Sources: Anatel

Subscribe to the leading business intelligence platform in Latin America with different tools for Providers, Contractors, Operators, Government, Legal, Financial and Insurance industries.

Subscribe to Latin America’s most trusted business intelligence platform.