A breakdown of Cochilco's latest copper price forecast

In its latest quarterly review of the market, Chilean state copper commission Cochilco lowered its average price forecast for 2016 to US$2.15/lb, compared with US$2.50/lb in its 3Q15 report.

For 2017 the agency is expecting a slight improvement in market conditions, forecasting an average price of US$2.22/lb.

Cochilco was forced to revise downward its price forecast in every single quarterly report in 2015.

And while that is unfortunate for the state of Chile's coffers, given its dependency on the ups and downs of the red metal, the agency has been right to do so as its final forecast for 2015 was US$2.53/lb, while the realized price was US$2.49/lb.

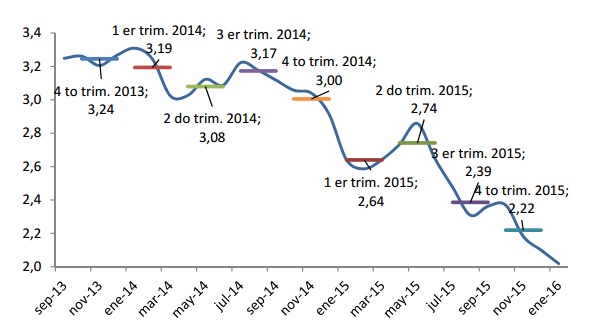

The price of copper has steadily eroded since the second half of 2014, when it declined from US$3.17/lb in 3Q14 to US$3.00/lb in 4Q14, followed by a sharp decline in 1Q15 when it dropped to US$2.64/lb, only to recover slightly the following quarter to US$2.74/lb.

The downward spiral picked up pace during the latter half of last year, when it dropped to an average of US$2.39/lb in the third quarter, finishing at US$2.22/lb.

And while the lower price scenario is not positive for Chile, the agency remains somewhat optimistic, as it anticipates a slight recovery for next year to US$2.20/lb, as it noted that if low prices continue to prevail, some producers will be forced to reduce production, although cuts will have to be of a significant magnitude to affect prices over the next few years.

EXTERNAL FACTORS

Cochilco said the strength of the US dollar was one of the main factors impacting the price of copper last year, with the greenback further bolstered by the Federal Reserve's decision to raise interest rates for the first time in close to a decade in December.

In Europe, another major consumer of copper, while economic growth was better than expected in the third quarter, at 1.6% year-on-year in the Eurozone, there are still concerns for the recovery of the continent's economy, which is why the quantitative easing program put in place by the European Central Bank is expected to continue this year, as ECB president Mario Draghi hinted recently.

But it is the state of the Chinese economy that is largely to blame for the current copper woes. As the leading consumer of the metal, accounting for close to 45% of total demand, copper's fate depends largely on which way the Chinese economy moves.

China's GDP grew 6.9% in 2015, its lowest annual rate in 25 years, as the country's leadership is trying to move to a consumption-driven economy.

The prospects for stronger growth in the coming years are not promising, as Chinese authorities are forecasting GDP will expand 6.8% this year, while for its 5-year plan (2016-20), the government has established minimum growth of 6.5%, Cochilco said.

DEMAND AND PRODUCTION

Cochilco said it expects global demand for refined copper to grow 2.3% in 2016 compared to a projected decline of 0.5% last year. The agency is now expecting demand in 2017 to expand 2.6%.

The figure was in line with its previous report – in which demand was expected to grow 2.2% this year.

Consumption this year is expected to be driven by India, China and Turkey, with growth rates forecast at 6.5%, 3.0% and 3.0% to 509,000t, 11.7Mt and 462,000t, respectively.

In terms of copper production, Cochilco lowered its projection as a result of the cuts announced by several mining companies during last quarter, and it now expects global output to grow 4.6% to 19.96Mt in 2016 and 2.2% to 20.4Mt in 2017, compared to its third quarter forecast of 19.2Mt for 2016.

The government agency expects copper output in Chile to be 5.77Mt this year, below its third quarter estimate of 5.90Mt, as a result of cuts. Production for 2017 is forecast to reach 5.95Mt.

Cochilco expects the global copper market to hit a surplus of 199,000t in 2016 and 168,000t in 2017.

Subscribe to the leading business intelligence platform in Latin America with different tools for Providers, Contractors, Operators, Government, Legal, Financial and Insurance industries.

News in: Mining & Metals (Chile)

Tianqi criticizes Chile's financial regulator, prepares legal action over SQM-Codelco deal

The Chinese company claims that the CMF's decision contradicts the spirit of the law, which is intended to protect investors, thus undermining tran...

How the mining industry is developing in the era of automation and digitization

BNamericas speaks with Liv Carroll, global mining and natural resources leader at consultancy Accenture, about the main technological trends in the...

Subscribe to Latin America’s most trusted business intelligence platform.

Other projects in: Mining & Metals (Chile)

Get critical information about thousands of Mining & Metals projects in Latin America: what stages they're in, capex, related companies, contacts and more.

- Project: Moon Mine Exploitation

- Current stage:

- Updated:

2 years ago

- Project: Collection and shipment of copper concentrate in Muelle Punta Caleta de Puerto Caldera SA

- Current stage:

- Updated:

3 years ago

- Project: Recovery of stockpiles from the Algarrobo work

- Current stage:

- Updated:

1 year ago

- Project: Rinconada de Alcones

- Current stage:

- Updated:

2 years ago

- Project: OPERATIONAL CONTINUITY OF THE TAMBO DE ORO MINING WORK

- Current stage:

- Updated:

2 years ago

- Project: Adaptations in ballast tanks, internal roads and camp

- Current stage:

- Updated:

3 years ago

- Project: Paprika Tailings Deposit

- Current stage:

- Updated:

2 years ago

- Project: Operational Restart Friends Plant

- Current stage:

- Updated:

3 years ago

- Project: Cerrillos Plant Operational Optimization

- Current stage:

- Updated:

6 months ago

- Project: Normalization Operational Continuity Vallenar Plant ENAMI

- Current stage:

- Updated:

2 years ago

Other companies in: Mining & Metals (Chile)

Get critical information about thousands of Mining & Metals companies in Latin America: their projects, contacts, shareholders, related news and more.

- Company: Glencore Chile S.A. (Glencore Chile)

- Company: China Nerín South America

- Company: Sigdo Koppers S.A. (Sigdo Koppers)

-

Sigdo Koppers is a Chilean business holding company with operations on five continents and activities in the service, industrial, and commercial and automotive sectors. The serv...

- Company: Antofagasta Minerals S.A. (Antofagasta Minerals)

-

Antofagasta Minerals S.A. is a Chilean mining company owned by London-based Antofagasta plc, the mining arm of Chile's Luksic group. Antofagasta Mineral is responsible for the o...